Sign the letter to get $100M of Big Oil out of the SAG Pension Plan

You’re invested in Big Oil.

Big Oil is in 99% of pensions and 401(k)s, and they’ve lost you a lot of money.

Sign the letter to get $100M of Big Oil out of the SAG Pension Plan

Getting out of Big Oil is one of the most impactful climate actions you can take.

Action

CO₂ reduced/year

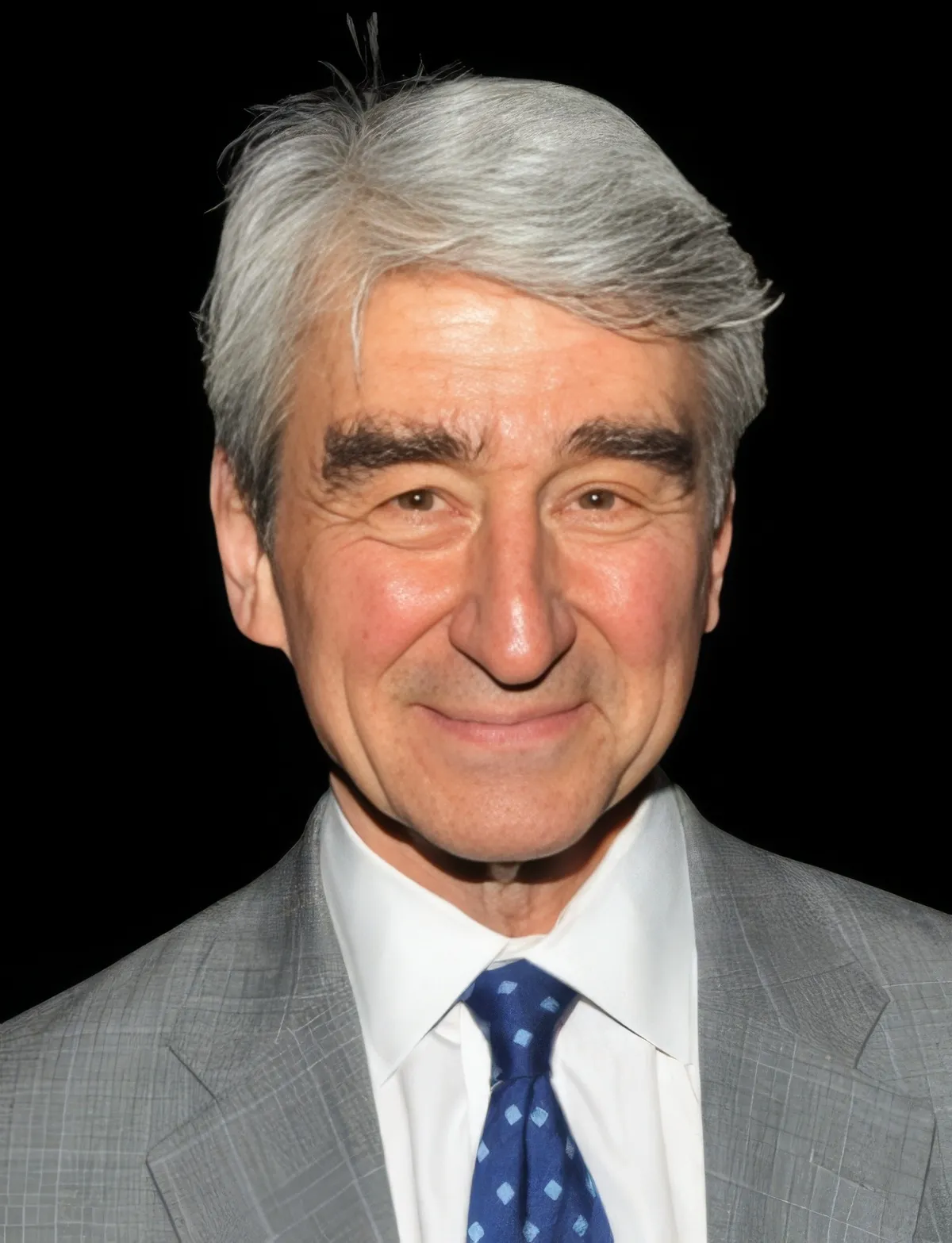

500+ actors are rallying to get $100M in Big Oil out of their pension fund.

A Letter to SAG-Producers Pension Trustees

Dear SAG-Producers Pension Trustees,

I am a proud member of SAG-AFTRA. I am grateful for our union and leaders, who saw us through the hard times with courage and wisdom.

I recently learned that our pension fund is invested to the tune of at least $100 million directly in fossil fuel companies. This is bad not just for the planet but for the wallets of every member of our union.

The data is clear that long-term investing in this sector results in worse economic returns. In the past 10 years, the fossil fuel sector has had the lowest returns of any sector in the economy.

So many people in our union depend on these pension funds in their retirement, and fossil fuel investments are hurting their ability to retire well.

For more data, see retirebigoil.org

For these reasons, I fully support removing fossil fuel companies from our SAG-Producers Pension Plan.

Signed,

You have lost money investing in fossil fuels.

Fossil fuel companies have been the worst performing part of the economy. If you invested $10k in 2014 in each sector you would make the least with your money in Big Oil.

Fossil fuels have been the riskiest sector to invest in

Investing in fossil fuels is fraught with risk due to their volatile market performance and increasing regulatory pressures. The sector's instability can make it a less attractive option for long-term financial growth. The energy sector has also been the most volatile sector of the economy.

Big Oil’s lobbying and heavy marketing drive the status quo.

Big Oil's lobbying efforts and extensive marketing campaigns are designed to maintain the status quo, making it challenging for alternative energy sources to gain traction. This strategy not only influences public perception but also impacts policy decisions, keeping fossil fuels at the forefront despite their declining performance.

Pensions and 401(k)s have been traditional and slow moving.

Pensions and 401(k)s traditionally conservative and slow to adapt to market changes. This cautious approach often results in missed opportunities for growth.

Big institutions have quit Big Oil

Major organizations are increasingly divesting from fossil fuels, recognizing the financial and environmental risks associated with such investments. This shift is driven by a growing awareness of the need for sustainable and responsible investment strategies.

New York City Pension

Three of New York City’s pension funds with assets totalling more than $200 billion completed divestment from fossil fuels in 2021. More than $4 billion was divested from major oil and gas companies, while ramping up investments in clean energy.

UC System Pension and Endowment

The University of California became the first major U.S. public university system to divest from fossil fuels, pulling billions from oil, gas, and coal by 2020. Citing climate risk and poor returns, they’ve since reallocated funds into clean tech and sustainable assets.

Rockefeller Foundation

Rooted in oil wealth, the Rockefeller Foundation has taken a historic turn—divesting its endowment from fossil fuels starting in 2020. The move signals a growing shift among legacy institutions embracing climate-forward investment strategies.

Get Big Oil out of your retirement savings.

Ensure your retirement savings align with your values by moving away from fossil fuel investments. This shift not only supports environmental sustainability but also enhances your financial security.

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)